A Coaching Model By Joseph Neizer, Young Couples & Couple Planning for Retirement Coach, CANADA

The ETCAP Coaching Model Helps families Anchor Their Financial Future (ETCAP – Explore, Tools, Clarify, Action Plans and Implementation)

The ETCAP Coaching Model Helps families Anchor Their Financial Future (ETCAP – Explore, Tools, Clarify, Action Plans and Implementation)

We can endure almost anything if we are centered, if we have some focus on our life. You can endure if you have an anchor.– Renita J. Weems

The goal of my coaching approach is to help enhance my client’s financial well-being and security. Moreover, I aim to bring financial stability to families by assisting them to discover their own personal anchor to which they can secure their financial lives.

Coaching is often viewed as a relationship between two individuals, the coach, and the client. The coach supports the client to overcome obstacles, challenges, or roadblocks standing in the way of the client in achieving their desired personal, professional, or spiritual goals. In coaching, the belief is that the client is the subject matter expert of their own lives and has the undiscovered solutions to overcoming their perceived obstacles. The role of the coach, therefore, is to work alongside the client to provide tools to help them uncover their own answers or solutions.

Financial well-being is very important. It aids in providing peace of mind and emotional security. Studies show that money may not be the sole cause of anxiety and stress for individuals and families. However, it often acts as a deterrent. This is especially seen during periods of financial and economic uncertainties as the world is currently experiencing.

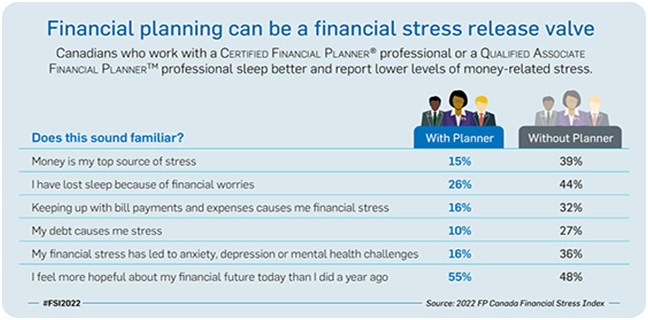

Research demonstrates a strong correlation between financial distress or economic hardship and a family’s emotional stability. The 2022 Canadian Financial Stress Index published in June 2022by (by FP Canada)outlines that money is the leading cause of stress for Canadian families. The survey reflects the experiences of 2,001 Canadians, looking at their source of stress. The report also reveals that those who engage the services of financial planning professionals including coaches often report much lower levels of money-related stress. Similar financial stress experiences were also reported in previous year’s surveys.

It is conceivable that other countries both developing and developed might reflect similar experiences as found in the Canadian survey.

Niche & Typical Clients:

The ideal or typical clients I often coach include the following:

Seniors who are approaching retirement or recently retired and wondering if they can retire comfortably, live independently, and still be able to live a purposeful life based on their personal interests and passions. The coaching and consultation include a view of the client’s total retirement income. Together, we also review the client’s post-retirement expenses among other things design a post-retirement budget. In addition, I support clients or retirees to find purpose in retirement, either through setting up their own businesses, consulting, volunteering, or uncovering the client’s unidentified goals.

Young Couples and Young Adults at the beginning of their careers and family lives who are wondering what key financial decisions or choices would be beneficial for their long-term goal; to build a solid and healthy financial foundation for themselves and their families.

Educating individuals and families, particularly New Immigrants and Visible Minorities assimilating into the Canadian financial culture or struggling to understand or make sense of the Canadian banking or financial system. Financial education or financial literacy is generally defined as a specific set of skills, knowledge, and education that enables a person to make informed decisions with the financial resources that they have. The benefits of being adequately financially literate include allowing the individual or family to make informed financial decisions that can lead to improved financial and economic security. Education also includes supporting clients in understanding basic financial budgeting concepts. An effective budget can assist clients in building a sense of financial security and well-being.

(ETCAP – Explore, Tools, Clarify, Action Plans and Implementation) Coaching Process:

-

Explore

My clients are supported in their goal to uncover the source or causes of their financial bottlenecks or misunderstandings. I encourage them to develop their own unique pathways to remove their financial blockages and support them by educating financial literacy and creating strategies for making financial decisions aligning with their individual or personal goals and aspirations.

-

Financial Tools

I leverage elements of coaching and appropriate financial tools and resources such as budgeting tools to enhance the client’s understanding of why they are “stuck financially.”

-

Clarifying Goals & Dreams

I provide clients assistance in uncovering/ clarifying their financial goals and objectives. Clients are supported through the development of sound and sustainable financial strategies and initiatives used to reach their financial goals and dreams.

-

Action Plans

A comprehensive action plan is composed to meet both the current and future goals and aspirations of the client. The plan makes provision for an emergency fund to protect self and family from unanticipated changes in life circumstances, loss of job, and health challenges. The plan also takes into account savings towards children’s education, retirement, and planning for life’s other important milestones.

-

Implementation

As a personal finance coach, I envision my role and strategies as a coach like that of someone holding a flashlight on a dark path. A flashlight is a tool, much like my coaching strategies used to illuminate a path. My clients may be journeying on a poorly lit or dark financial path, however, the flashlight provides light and clarity until the client can independently move along the path holding their own flashlight or until the path is lit enough that they no longer require a flashlight.

My overall passion is to help families build or create the foundation for sustainable generational wealth.

Case Study:

The following is a summary of a recent client consultation I had. The client’s name has been changed to ensure confidentiality.

Jack recently requested a consultation because he was exceptionally stressed by his financial situation. He felt the financial circumstances were causing a severe strain on his family and other relationships. Jack is employed and receives an above-average salary. However, the majority of his income was used to service his debts and household expenses. He is only able to cover the minimum payments on his credit card balances. To make matters worse, his car which he needs for work, broke down. He relayed that he has no easy means of getting to work. His workplace is outside the normal public transit route, and he does not have any savings or financial reserves to help him finance or lease a car.

After about a 40-minute conversation with Jack and a quick review of his finances with the aid of a simple budgeting tool, Jack realized that the amount of money he spends monthly on his toll route to work was more than double the amount of money he will need to finance a new car. All that Jack needed to do was a slight adjustment to his daily schedule. Leaving home 30 minutes earlier, avoid the toll route by using an alternate route to work. The money saved by not using the toll route was more than enough to finance the new car purchase with leftovers to cover other debt obligations.

A simple budgeting tool was able to help Jack put his life back together and ease the stress on him and his relationships, the benefit of coaching and financial literacy.

Learn How to Create Your Own Coaching Model

Your Coaching Model reflects your values,

philosophies, and beliefs and must communicate who you will coach

and the problems you will solve. Read more about creating your coaching model

References

FP Canada: https://fpcanada.ca/planners/2022-financial-stress-index

The Canadian National Financial Education Council: https://www.financialeducatorscouncil.org/