Cathie Wood’s flagship fund Ark Innovation hit its lowest point of the year on Monday amid further selling in innovation stocks.

Ark Innovation‘s drop of as much as 5% on Monday dragged the “disruptive innovation” ETF below its February low, a level that many investors are watching as a barometer for the larger tech sector.

Ark Innovation is now nearly 35% off its most recent high.

Wood’s core ETF is now down nearly 13% this month and more than 15% year-to-date.

Some of Ark Innovation’s top holdings took big hits on Monday as the Nasdaq Composite dropped as much as 1.5%. Tesla fell 4% and Teladoc Health dropped 4.6%. Square and Roku fell nearly 6% and 3%, respectively. DraftKings declined more than 3% and Zillow lost over 2%.

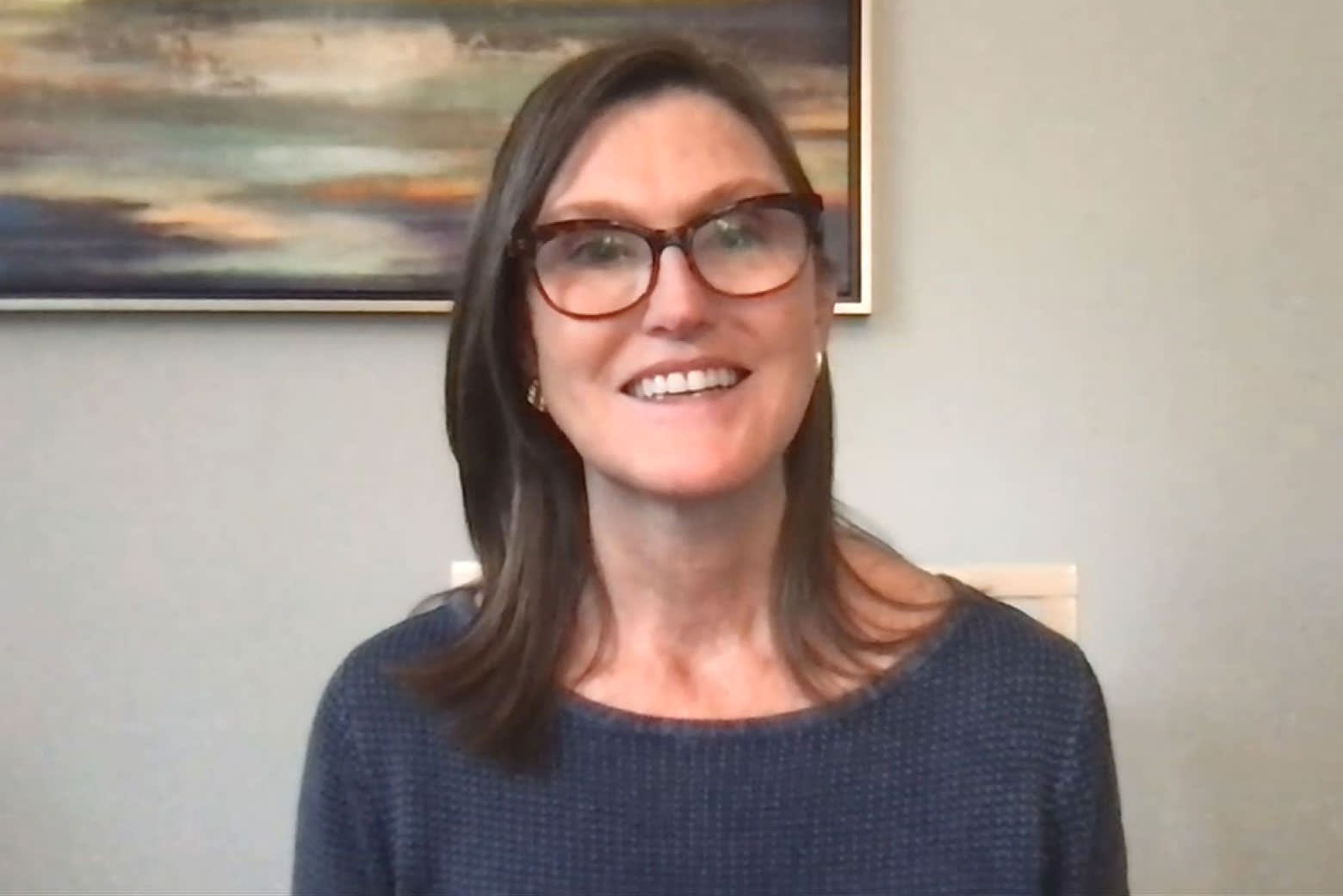

Wood told CNBC on Friday that she loves the set-up for her ETFs following the most recent sell-off in technology stocks. She said she envisions her strategies posting a compound annual rate of return between 25% and 30%.

“I love this set-up,” Wood said Friday on CNBC’s “Closing Bell.” “The worst thing that could have happened to us is to have the market narrowly focus on just our ilk of stock — the innovation space.”

However, more than $1.1 billion of fund flows have left Ark Innovation this month. Ark Invest — including its five core ETFs — has lost about nearly $2 billion in investor dollars in May, according to FactSet.

200-day moving average long gone

Ark Innovation broke below its 200-day moving average, a key technical level watched by traders that is essentially the average of the past 200 closing prices.

“The issue with ARKK and other speculative growth ETFs is that short-term rallies have been aggressively faded for three months now,” Frank Cappelleri, Instinet executive director, told CNBC. “The ETF will have to do more than just bounce for a few days to convince traders otherwise.”

“In other words, simply getting back above the 200-day moving average won’t mean much without upside follow through. That continues to be the biggest concern,” Cappelleri added.

Wood’s other ETFs also experienced intense selling pressure on Monday. The Ark Next Generation ETF lost 3.7%, bringing its month-to-date losses to more than 11%. The Ark Genomic Revolution ETF and the Ark Autonomous Technology and Robotics ETF fell 3.7% and 2.5%, respectively. The pair are down about 13% and 5% this month alone. The Ark Fintech Innovation ETF dropped 3.6%, bringing its losses for the month to nearly 9%.

The Ark Autonomous Technology and Robotics ETF is Wood’s only fund in the green for the year, up about 3%.

Become a smarter investor with CNBC Pro.

Get stock picks, analyst calls, exclusive interviews and access to CNBC TV.

Sign up to start a free trial today