Many events have unfolded since Chief Executive’s first survey of U.S. HR leaders this past February. Accelerating Covid-19 vaccinations, re-opening of businesses and soaring consumer demand have all been driving positive economic momentum. At the same time, growing shortages of materials and skilled labor, fears of inflation and concerns about increases to taxes and regulation are casting shadows over the recovery.

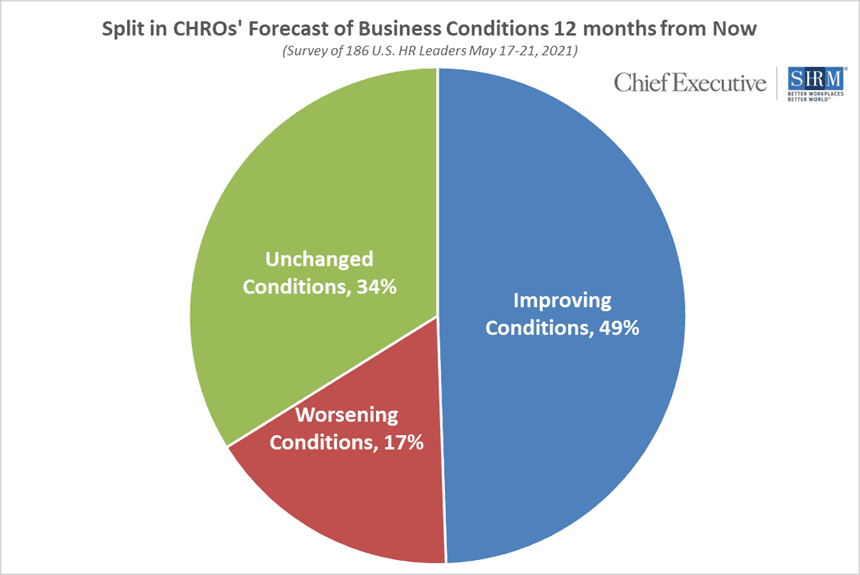

That mixed picture is clearly reflected in our latest CHRO Confidence Index survey, conducted by Chief Executive and the Society for Human Resource Management (SHRM). HR leaders’ confidence in an improving business landscape over the next 12 months continues to grow, outstripping that of their counterparts in the C-Suite, even as they report increasing employee burnout and requests for help in dealing with mental health issues.

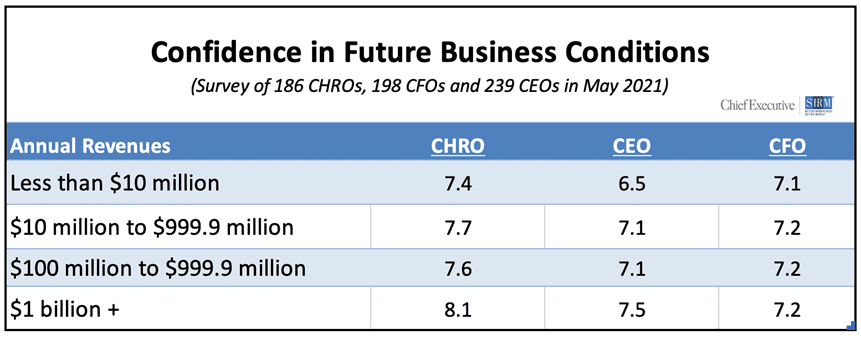

CHROs rate their confidence in future business conditions a 7.8 out of 10 in May—or “very good” according to our 10-point scale. That’s 3 percent higher than their 7.6/10 rating in February. Both CEOs and CFOs rated their confidence in future business conditions a 7.2 out of 10 when polled earlier this month by StrategicCFO360 and Chief Executive.

CHROs’ confidence in the current business environment has also gained plenty of ground since we last polled them, now 7.6/10 versus 6.5/10 in February—a 17 percent gain. CEOs and CFOs agree that conditions have improved since February: CFOs rate the current environment 6.7 out of 10–up 11 percent since February—and CEOs rate it 7, up 13 percent over the same period.

CHROs’ confidence in the current business environment has also gained plenty of ground since we last polled them, now 7.6/10 versus 6.5/10 in February—a 17 percent gain. CEOs and CFOs agree that conditions have improved since February: CFOs rate the current environment 6.7 out of 10–up 11 percent since February—and CEOs rate it 7, up 13 percent over the same period.

Overall, the vast majority of CHROs say they’re optimistic about the year ahead. Only 1 percent of those participating in our survey said they expect business conditions 12 months out to be weak or poor (4 or below on our scale), and only 3 percent said the same of current conditions. The proportion of CHROs who believe current conditions are good to excellent (6 or above on our scale) is now 88 percent, an 11 percent increase from Q1.

Rhonda Hall, VP of human resources and organizational development at UFCU, a large financial services company, says conditions will improve from the 8/10 she rates them now to a perfect 10/10 by this time next year. “Employees are returning to work, there is reduced unemployment, increased spending thus re-booting the economy,” she says. “People are starting to travel. Life is morphing into the ‘Next Normal’ where new habits have been created and will be sustained.”

Rhonda Hall, VP of human resources and organizational development at UFCU, a large financial services company, says conditions will improve from the 8/10 she rates them now to a perfect 10/10 by this time next year. “Employees are returning to work, there is reduced unemployment, increased spending thus re-booting the economy,” she says. “People are starting to travel. Life is morphing into the ‘Next Normal’ where new habits have been created and will be sustained.”

John Batchelor, VP of HR at Virginia Air Distributors, agrees and forecasts business conditions will improve from 8/10 to 9/10 in the next 12 months. “The economy was hot before Covid-19, and then massive amounts of stimulus was injected over the last 15 months, yet interest rates remain historically low. Additionally, I believe the supply chain will work itself out in the next 6 months or so,” he says.

Not everyone is convinced. “Sales are great, but talent recruitment is going to become more difficult with some external political policies and a shrinking engaged employee labor pool,” says Jennifer Caunin, vice president of human resources at Clippard Instrument Laboratory. She believes business conditions will deteriorate over the next 12 months.

Employee well-being appears to be another growing concern among HR chiefs. In February, 34 percent of CHROs said they were anticipating that the mental health of employees would be a workforce-related challenge in 2021. This month, 65 percent report that employees are indeed feeling burnt out, and 63 percent of CHROs say that employees at their company have reached out to them for mental health resources.

“The Covid-19 pandemic forced many employers to re-evaluate their priorities,” says Dr. Alexander Alonso, chief knowledge officer at SHRM and a partner in this research. “What kept employee engagement and morale high prior to the pandemic may not be the case now. This is a unique opportunity for organizations to continue to innovate their workplace policies and benefits, especially as Covid restrictions lift and more and more employees return to work.”

Leadership, Employee Engagement and Mental Health

When asked to assess employee engagement at their company, 32 percent of CHROs say it has decreased since the start of the pandemic, 41 percent indicated that it hadn’t changed, and 27 percent say it has improved. These numbers signal there may be an opportunity for change in the wake of Covid-19, especially as businesses begin to make crucial decisions about the workplace, employee benefits and health policies.

“Organizational leadership defines the employee experience,” says SHRM’s Alonso. “With so many employees experiencing burnout right now, and many organizations struggling to attract and retain talent, organizations must find ways to positively impact employee engagement and mental health. Leadership development is a good place to start.”

To improve employee engagement, 50 percent of surveyed CHROs say they’re planning to increase their investment in workforce initiatives in 2021. The top three activities they say will be used to make a positive impact on employee engagement are emphasizing the core values and mission of the company (82 percent), more recognition and reward for employee achievements (81 percent) and acting upon suggestions provided by employees (80 percent).

To improve employee engagement, 50 percent of surveyed CHROs say they’re planning to increase their investment in workforce initiatives in 2021. The top three activities they say will be used to make a positive impact on employee engagement are emphasizing the core values and mission of the company (82 percent), more recognition and reward for employee achievements (81 percent) and acting upon suggestions provided by employees (80 percent).

Other popular initiatives include asking employees for feedback in more formal channels (77 percent), providing the right tools to do their jobs and support employee success (76 percent) and providing regular feedback (74 percent).

Forecasting for the Year Ahead

Meanwhile, CHROs’ confidence that profits, revenue, hiring and capital expenditures will increase by this time next year continues to rise, and is higher now than it was in February—and in line with CEO and CFO projections.

The proportion of CHROs expecting their headcount to increase by this time next year has risen 23 percent since February. Overall, 65 percent of CHROs forecast adding to their workforce over the next 12 months—compared to 68 percent of CEOs and 66 percent of CFOs.

The number of CHROs forecasting increases in revenues and profitability has also grown since February, up 8 percent and 5 percent, respectively. According to the Q2 CHRO Confidence Index, 84 percent expect revenues to climb and 74 percent project profits to do the same.

The number of CHROs forecasting increases in revenues and profitability has also grown since February, up 8 percent and 5 percent, respectively. According to the Q2 CHRO Confidence Index, 84 percent expect revenues to climb and 74 percent project profits to do the same.

Capital expenditures are also expected to rise in the coming year, according to 68 percent of CHROs. That number is 29 percent higher than it was in February—and once again in line with their C-Suite peers’ forecasts.

Sector & Size Views

Looking at forecasts by sector, our forward-looking indicator shows advertising/media CHROs among the most optimistic in the future (rating their outlook for business an 8.8 out of 10) while their industrial manufacturing and professional services counterparts share the most cautious outlook of the group, at 7.3/10.

CHROs in industrial manufacturing lost the most confidence in future business conditions since we last polled them in Q1; their rating is down 10 percent to 7.3, from 8.1 in February, on concerns over labor and materials shortages and the impact of inflation on demand. CEOs in the sector have shared the same concerns, and their confidence level has also dropped, by 5 percent since February.

“Things are through the roof in terms of sales. This won’t last. Inflation is becoming more of an issue and lack of labor supply is hurting business,” says an industrial manufacturing VP of HR participating in our survey.

CHROs in professional services attribute their cautionary stance to personnel shortages and federal policy changes.

At the other end of the scale, tech CHROs experienced the largest jump in confidence this quarter, rating their outlook for business 12 months from now a 7.8/10, up 28 percent since February and by far the largest increase recorded this quarter.

“We’re in a strong market, seeing a lot of lift from remote business conditions and increased desire to move from offline to online,” explained an HR leader in the technology space.

Tech CEOs have also gained confidence since February, up 10 percent.

Looking at confidence levels by company size, our data shows CHROs are more optimistic than CEOs and CFOs across all cohorts—although those at companies with $1 billion+ in annual revenues have gained the most confidence quarter-over-quarter, up 7 percent to 8.1/10 from 7.5/10 in Q1.

Looking at confidence levels by company size, our data shows CHROs are more optimistic than CEOs and CFOs across all cohorts—although those at companies with $1 billion+ in annual revenues have gained the most confidence quarter-over-quarter, up 7 percent to 8.1/10 from 7.5/10 in Q1.

About the CHRO Confidence Index

About the CHRO Confidence Index

The CHRO Confidence Index is a quarterly pulse survey of CHROs and HR executives on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every quarter, Chief Executive Group partners with SHRM (the Society for Human Resource Management) to survey hundreds of CHROs and HR chiefs across America, at organizations of all types and sizes, to compile our CHRO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and hiring for the year ahead.