Products You May Like

As global billionaire rankings continue to be updated using modern valuation standards, renewed attention has turned to how historical fortunes compare when measured against today’s financial structures.

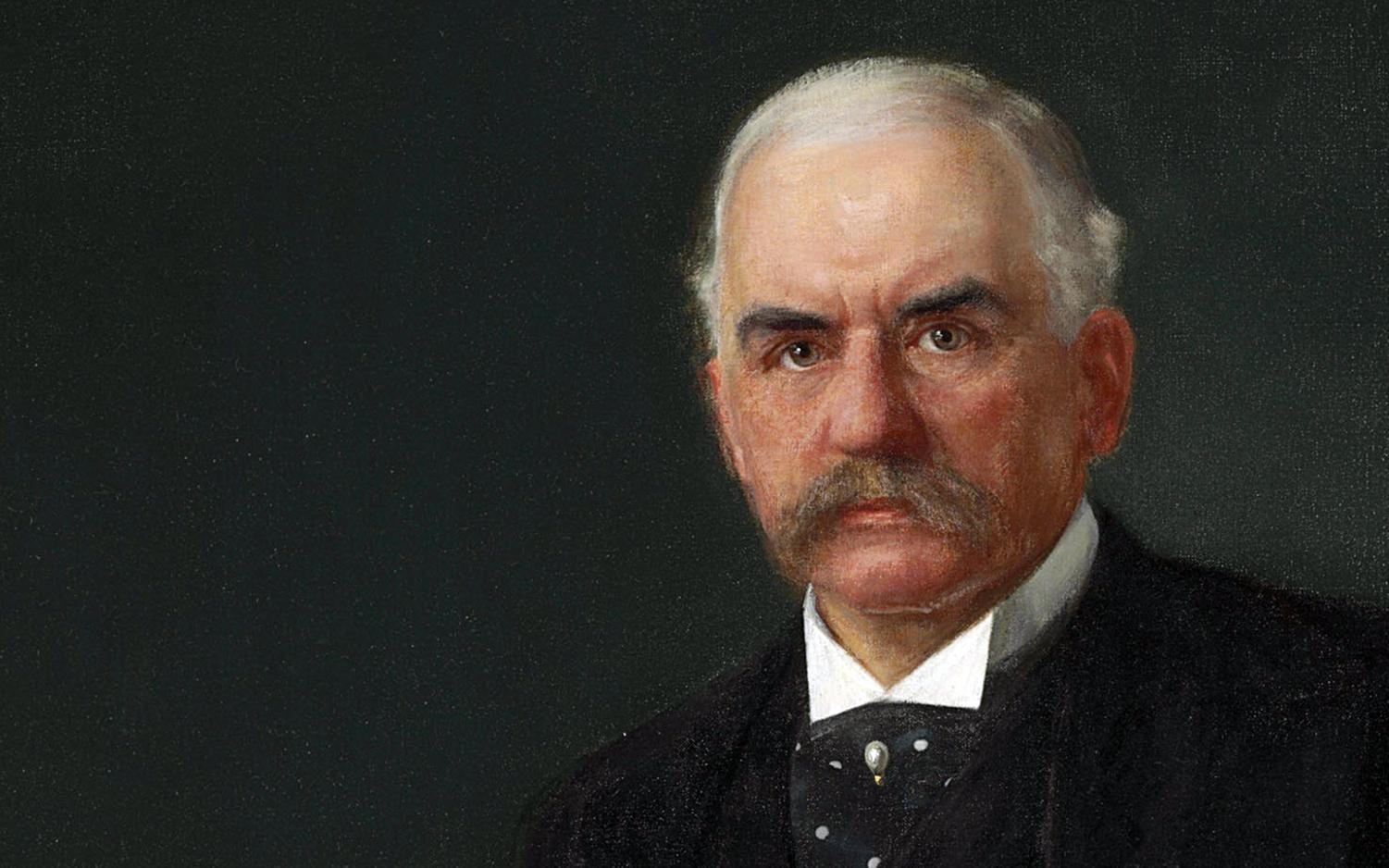

When J. P. Morgan died in 1913, his personal fortune was estimated at roughly $80 million, a figure that placed him among the richest individuals of his era but understated his economic position even by contemporary accounts.

At the time, Morgan was not just a wealthy banker. He functioned as a central coordinator of American capital during financial crises, stepping in when markets froze and before the United States had a formal central bank.

Standard inflation adjustments place Morgan’s personal wealth at roughly $2.5 to $3 billion in today’s dollars. That method captures purchasing power, but it reflects only cash and assets held directly in his name, not the financial control he exercised.

Modern wealth measurement places greater weight on equity retention, governance rights, and long-term ownership across institutions. Those mechanisms did not fully exist during Morgan’s lifetime, but they now define how financial influence converts into personal net worth.

Morgan built influence by assembling systems rather than accumulating passive holdings. He helped consolidate railroads, shaped industrial trusts, and played a central role in the creation of major corporations, including U.S. Steel, while coordinating private banking syndicates during repeated market panics.

In several crises, Morgan’s intervention effectively replaced functions that would later be formalised under the Federal Reserve. Markets responded not only to his capital, but to his ability to organise liquidity and impose stability.

Under today’s financial architecture, individuals who assemble and control comparable platforms typically retain substantial equity stakes that appreciate over decades. That structure dramatically alters how power translates into wealth on paper.

Historical finance models that attempt to translate Morgan’s level of control into modern valuation terms consistently exceed inflation-only estimates. Even conservative approaches that apply modest premiums for institutional control move his implied net worth well into the high single-digit billions.

Broader interpretations, using contemporary assumptions about equity retention and long-term compounding, place the equivalent value in the tens of billions. Under those frameworks, figures above $30 billion align with how modern markets price systemic financial influence.

The gap between Morgan’s recorded fortune and modern estimates reflects structural change rather than reassessment of his actions. Capital today moves faster, scales globally, and rewards system builders more directly than it did in the early 20th century.

Morgan exercised authority at the formation stage of modern finance, before mechanisms existed to convert that authority into enduring personal equity. The institutions he helped shape later became far more efficient at translating control into individual wealth.

Measured against current valuation norms rather than historical accounting, Morgan’s economic position aligns more closely with today’s highest-ranked financial architects than with simple inflation-adjusted comparisons.

That contrast explains why his legacy continues to surface whenever modern wealth rankings are reassessed. The question is no longer how much Morgan was worth in his lifetime, but how differently financial power is rewarded now compared to when he held it.